目次

第三次産業

タクシー

Projected Revenues (USD) and Expected Change in Revenues (%)

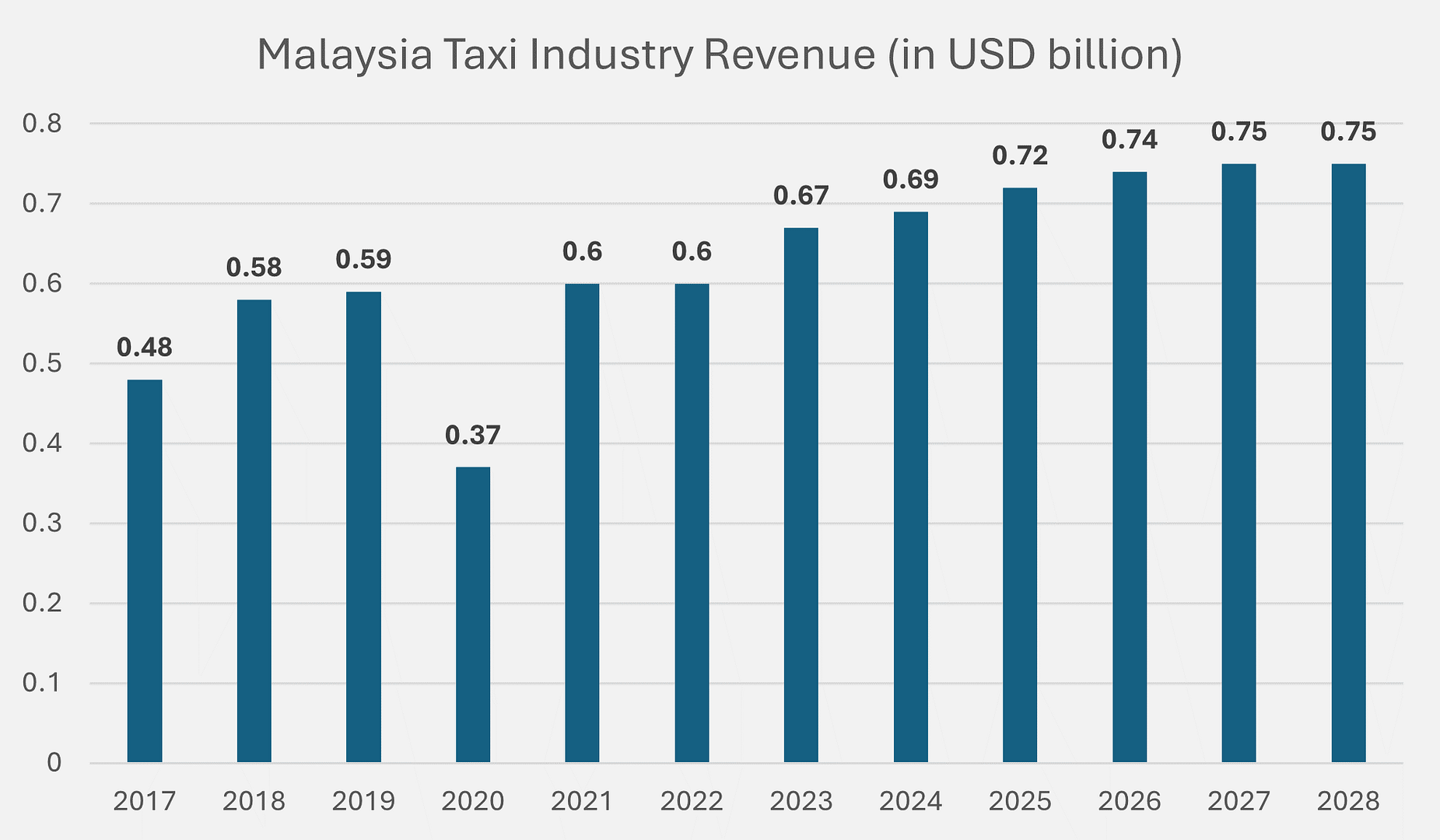

タクシー業界は、路上配車などのオフラインタクシーサービスと、GrabCarやEzCabなどの配車プラットフォームを利用するオンラインタクシーサービスで構成されています。Statista(2024年)によると、マレーシアのタクシー業界の収益は2024年までに6億9,000万米ドルに達すると予測されています。また、2024年から2028年までの推定年間成長率は2.11%であり、2028年までに約7億5,000万米ドルの収益につながると予想されています。ただし、業界の持続的な成長にもかかわらず、業界のユーザー普及率が低下傾向にあることに留意することが重要です。マレーシアのタクシー業界のユーザー普及率は、2024年に11.2%と予測されるのに対し、2028年までに10.3%に減少すると推定されています。これは、Grabが業界を支配する以前の同国の既存のタクシーシステムに基づいていると言われています。これまでマレーシアのタクシー制度は、課税運転手に個別に許可証を発行するリース制度で運営されていました。現在、これらのドライバーのほとんどは仕事を確保するためにGrabのドライバーになり、同社がタクシー業界における市場シェアをさらに拡大しています。

運送

運送業界は、郵便会社と物流会社で構成されており、手紙、書類、小さな荷物の配達など、比較的軽量で体積の少ない荷物の輸送サービスを提供しています。今日の電子商取引の急速な成長により、CEP産業は世界中で大幅な成長をもたらし、2023年の市場規模は4,573億8,000万米ドルと推定されています(Mordor Intelligence、2024)。また、市場は成長を続け、2028年までに10.64%の年間成長率で7,581億7,000万米ドルに達すると予測されています。2024年のマレーシアのCEP市場規模は15.8億米ドルと推定され、2030年までに6.07%のCAGRで22.4億米ドルに達すると予測されています。Mordor Intelligence(2024)によると、マレーシアのCEP産業は現在、年間成長率6.98%で最も急速に成長している市場であるとされています。国内に450以上のドロップポイントと25のゲートウェイを備えたJ&T Expressは、マレーシアのCEP業界の市場リーダーとしての地位を確立しており、DHL、FedEx、Pos Malaysiaなどの他のプレーヤーが注目を集めています。また、配車会社がマレーシアで独自の宅配サービスを提供するGrabとinDriveによって、マレーシアの宅配業界を浸食していることも注視する必要があるでしょう。

交通機関

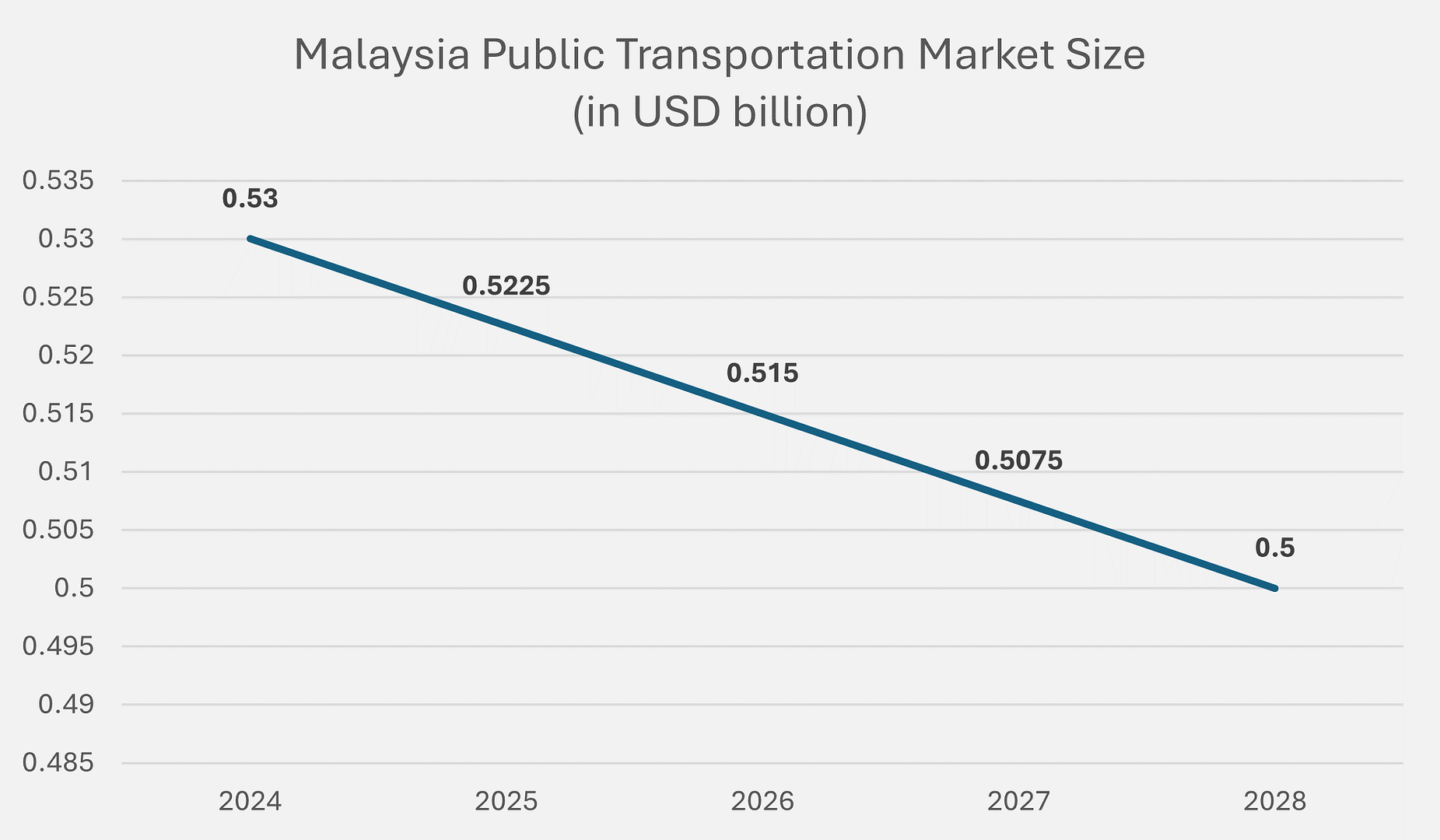

公共交通機関には、あらかじめスケジュールとルートが定められているバス、電車、高速交通機関、地下鉄が含まれています。マレーシアの公共交通産業は、2024年までに5億3,000万米ドルの収益が見込まれる市場です。マレーシアでは新しい鉄道路線やバスが導入されていますが、この業界は下降傾向にあり、市場規模は5億米ドルと予測されています。2028年までに5億ドルに達すると予想されていますが、これは現在の市場規模よりも比較的低く、年間成長率は-1.45%です(Statista, 2024)。

卸小売

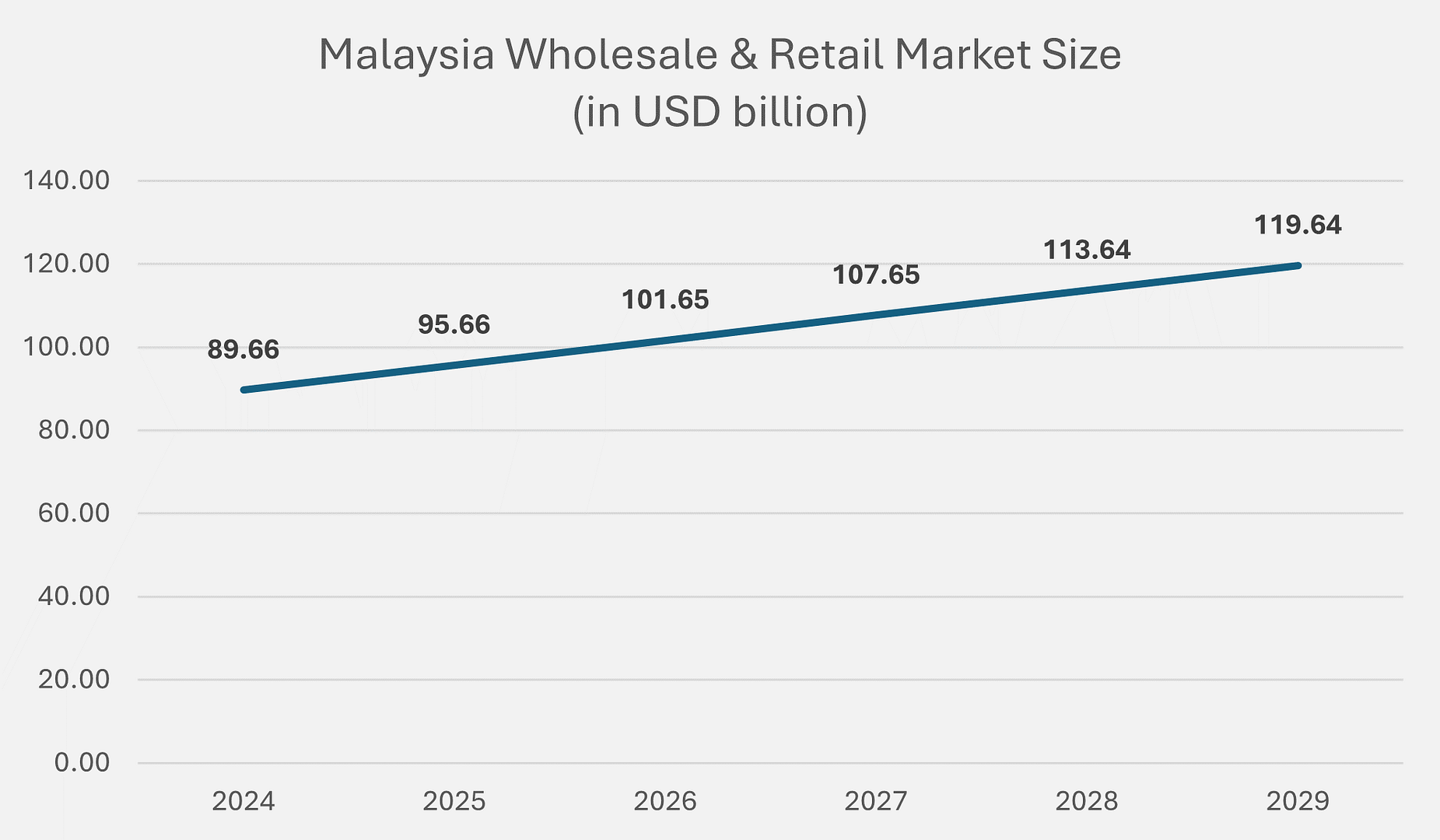

Sakrabani、Teoh、Amran(2019)によると、マレーシアの卸小売業界は国のGDPに大きく貢献しており、国のGDPの45%以上がこの業界から生み出されています。マレーシアの業界の市場規模は、2024年に約896億6,000万米ドルと予測されており、市場規模は2029年までに1,196億4,000万米ドルに達し、CAGRは5.94%になると予測されています(Mordor Intelligence、2024)。2023年、マレーシアの卸小売業界は、12月に過去最高の月間売上高を記録しました(The Edge、2024)。マレーシアの卸売小売業界は、2020年に同国の移動制限令(MCO)により業界が縮小して以来、着実に上昇傾向にあります。卸売と小売という同じ業界に属していても、卸売業者と小売業者はビジネスモデルが明確に異なります。たとえば、NSKのような卸売業者はメーカーと協力し、企業間(B2B)モデルに基づいて事業を行っており、小売業者に対する販売代理店として、または低所得層の消費者に対する小売業者として機能しています。一方、イオンのような小売業者は、個人の最終消費者に製品を販売する企業間消費者(B2C)モデルで、購買力の高い消費者をターゲットにしています。また、Jaya Grocerのような小売業者は、高級輸入品の小売を通じて高所得層の消費者向けの小売店としての役割を果たしています。

銀行

この国の銀行業界は、マレーシア人の資金調達において重要な役割を果たしており、2020年の銀行口座普及率は92%に達し、アジアの銀行口座普及率で6位にランクされています(Statista、2024年)。ここでの銀行業界は、主に商業銀行や投資銀行を含む従来の銀行業務を中心に展開しています。2023年のマレーシアの銀行システムの自己資本利益率(ROE)は11.6%と報告されており、外部の不確実性の中で消費者ローンがビジネスローンを上回っているため、2024年には約5%の健全な成長が予想されています(Dhesi、2023年)。

観光

観光・接客業は、主にホテル滞在などの短期レンタルサービスに重点を置いています。ホスピタリティ業界は、2020年の新型コロナウイルス感染症(COVID-19)のパンデミックが発生した際に最も大きな影響を受けた業界の1つで、約120軒のホテルが閉鎖され、全体で65億RMの収益が失われました。2022年の国境開放と観光改革を目的とした国家観光政策(NTP)などのマレーシア政府の戦略を受けて、観光とホスピタリティの市場は回復の兆しを見せています。Mordor Intelligence(2024)の調査結果によると、マレーシアのホスピタリティ業界は、2024年に6.5%以上のCAGRで40億米ドルの市場が見込まれています。マレーシア投資開発庁によると、観光収入は2030年までに約1,100億ドルに達すると予想されており、市場の上昇傾向は楽観的です。

外食産業

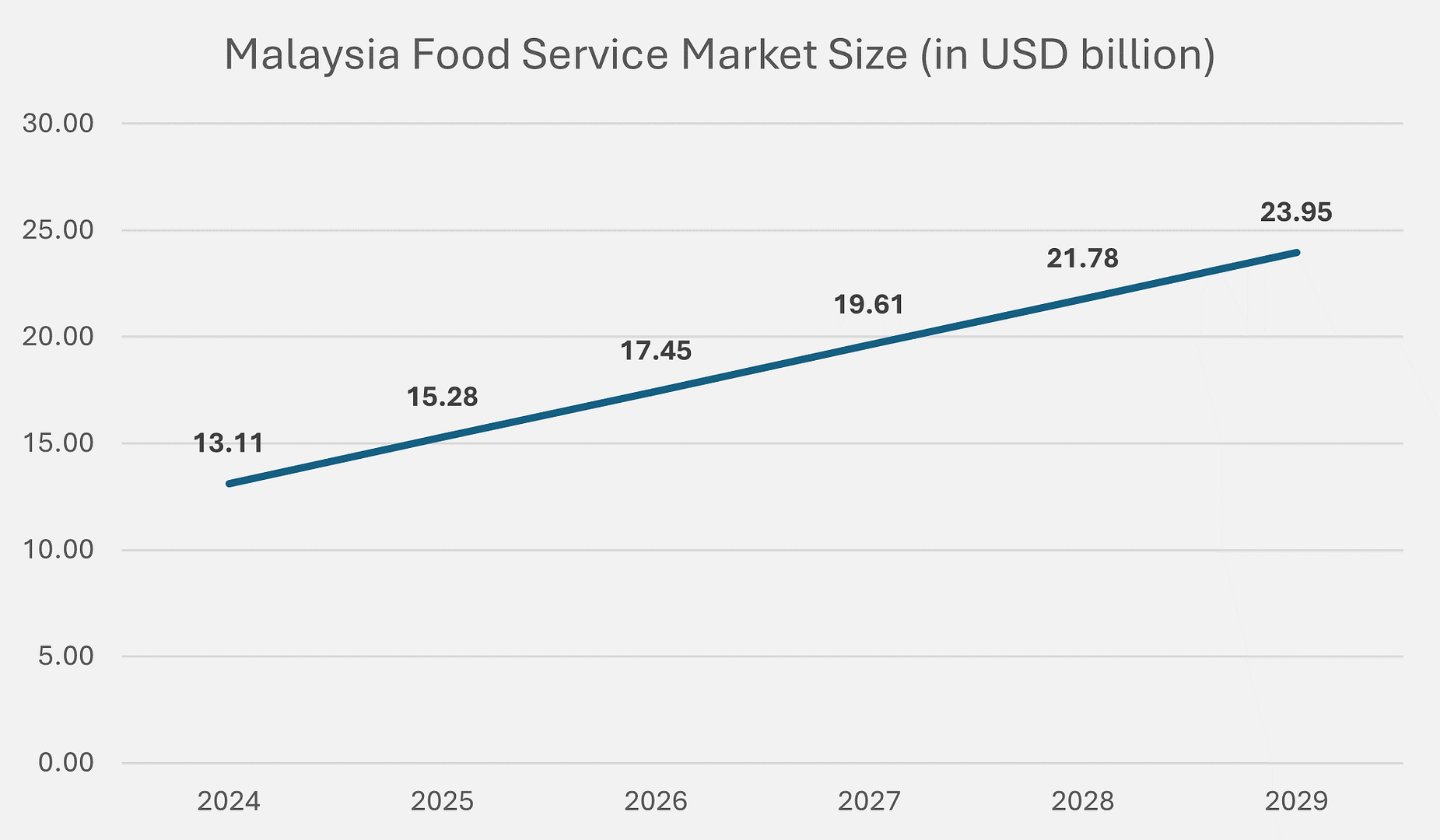

外食産業は、食べ物や飲み物を調理して顧客に提供するサービスビジネスで構成されます。レストラン業界は主に社内での食事体験に焦点を当てています。マレーシアの外食産業の市場規模は、2024年に131億1,000万米ドルと推定され、2024年から2029年までのCAGRは12.81%で、2029年には239億5,000万米ドルに達すると予測されています(Mordor Intelligence、2024)。業界で最も急速に成長しているセグメントは、消費者の利便性と標準化された品質に対する需要が高まっているため、CAGRが12.97%と予測されるチェーン型店舗です。

フィンテック

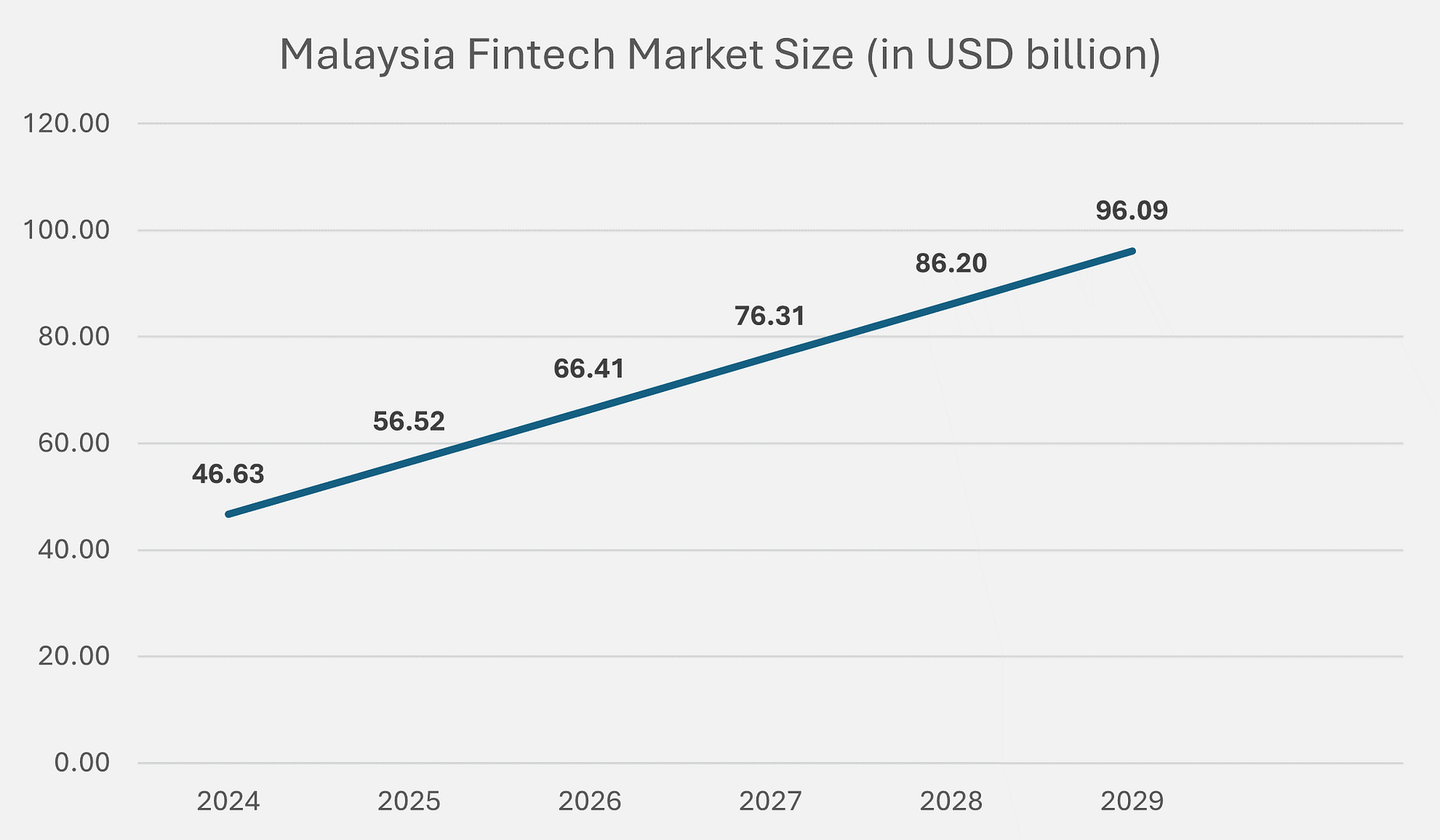

フィンテック業界は、金融サービスのプロセスを改善および自動化するための革新的なテクノロジーを提供する金融機関とテクノロジー企業で構成されています。マレーシアのフィンテック業界も、2020年の新型コロナウイルス感染症(COVID-19)パンデミック発生時の同国のロックダウンと移動制限令(MCO)により、取引全体が減少し、深刻な打撃を受けました。ただし、マレーシアでのフィンテックの導入は、業界が2020年以来大幅な成長を遂げたため、同国のMCOに起因する可能性も指摘されています。Mordor Intelligence(2024)の調査結果によると、マレーシアのフィンテック産業の市場規模は2024年に466億3,000万米ドルに達し、指数関数的に増加すると予想されています。成長率は15.56%のCAGRで、2029年までに960億9,000万米ドルに達すると予想されています。インターネットの普及とデータの手頃な価格の増加により、マレーシアのフィンテック産業の上昇傾向は今後数年間でさらに盛り上がるでしょう。