Table of Contents

第二次産業

建設

Building with visions

GlobalData(2024)によると、シンガポールの建設市場はUSDで記録されています。同社の予測によれば、2025年から2028年までの間に4%を超えるAAGRを達成すると見込まれています。シンガポールの建設市場における主な貢献者は以下の通りです。

- Samsung Group

- Penta-Ocean Construction Co Ltd

- Shanghai Urban Construction (Group) Corp

- Chip Eng Seng Corporation Ltd

- Temasek Holdings (Private) Ltd

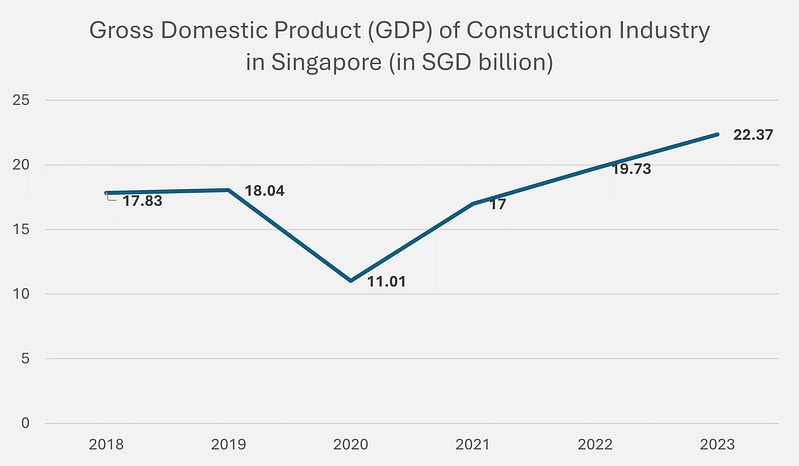

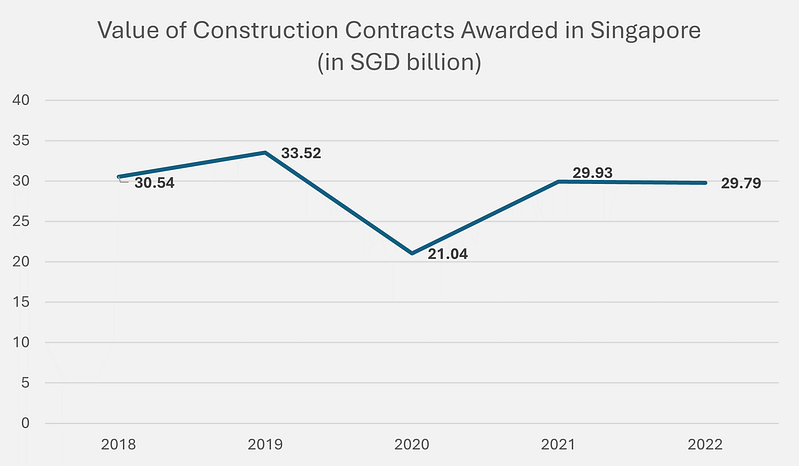

シンガポールの民間部門の建設需要は、商業施設の再開発を含む住宅プロジェクトと産業ベースの施設に基づいて、2024年に140億シンガポールドルから170億シンガポールドルの需要を達成すると予測されています(viAct、2024)。一方、公共部門における建設需要も、2024年には180億シンガポールドルから210億シンガポールドルと見込まれています。これは、HDBの新しい受注生産(BTO)、インフラ整備、チャンギ空港ターミナル5、南北の新しいブリックランドMRT駅などの公共部門プロジェクトに由来します。シンガポール建築建設庁(BCA)によると、2025年から2028年の予測期間中に、年間310億シンガポールドルから380億シンガポールドルの建設需要が見込まれています(BCA、2024)。ただし、2020年の新型コロナウイルス感染症(COVID-19)パンデミックの影響で、シンガポールで落札された建設契約の金額が大幅に減少したことがあります(Statista、2023)。シンガポールは2020年以降、建設業界のGDPへの寄与が増加しており、業界の経済成長を示しています。

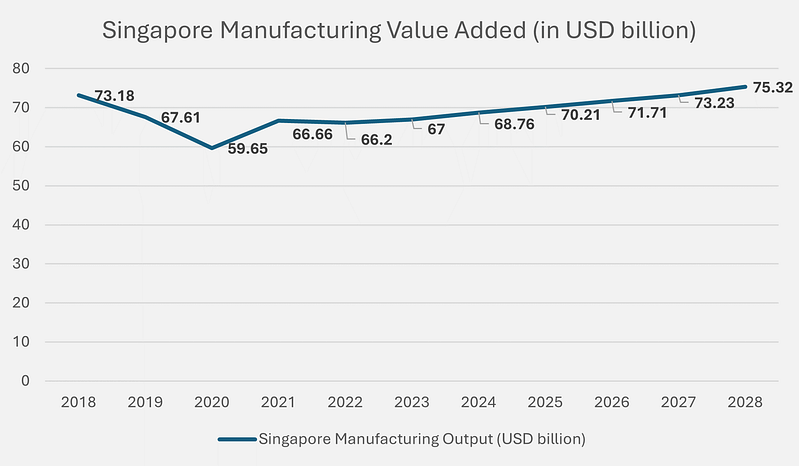

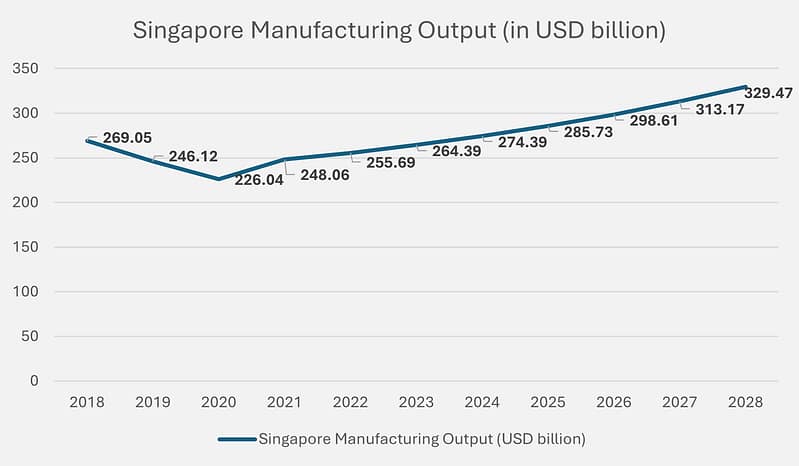

製造業

シンガポールの製造業は、国の経済の重要な要素であり、国内総生産(GDP)の20%以上を占めています(Hirschmann、2023)。自動化された集約的な生産により、シンガポールの製造業は低コストで労働力を提供しています。自動化密度に関しては、シンガポールの製造業は世界第2位です。Statista(2024)の調査によると、2024年にシンガポールの製造業市場の付加価値は約687億6,000万米ドルに達し、2024年から2028年までの年間平均成長率(CAGR)は2.30%と推定されています。シンガポールの地位は、先進的な製造技術によって支えられており、これはインダストリー4.0の第4次産業革命において競争力を維持するプラットフォームとなっています(ITA、2024)。