目次

第三次産業

観光

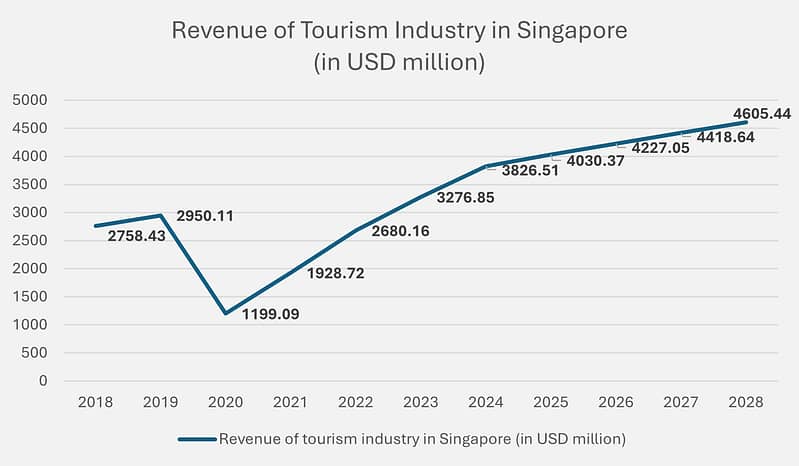

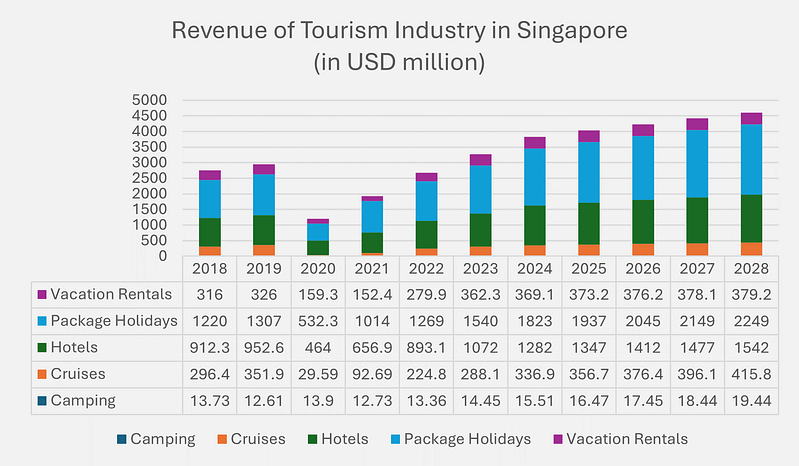

Lim(2024)によると、新型コロナウイルス感染症(COVID-19)のパンデミックからの世界的な旅行回復の中で、シンガポールの観光産業は成長が見込まれています。2023年には、シンガポールへの外国人観光客数が2倍以上に増加し、2022年の630万人から合計1,360万人に達しました。同国の観光収入も、シンガポール観光局(STB)の2023年の予測を上回り、推定額は245億~260億シンガポールドルとなっています。業界の成長は、Statista(2024)によっても補完されており、2024年までに市場の収益が約521億1,000万シンガポールドルに達すると予測されています。また、パッケージ旅行の需要が増加しており、Statista(2023)によると、この割合は498万人に達すると予測されています。さらに、持続可能で環境に配慮した旅行の選択肢への関心も高まっています。これらの要因から、シンガポールの観光業界は今後も成長が見込まれます。成功を目指す企業は、環境に配慮した慣行に焦点を当てることで市場シェアを確実に拡大するでしょう。

卸小売

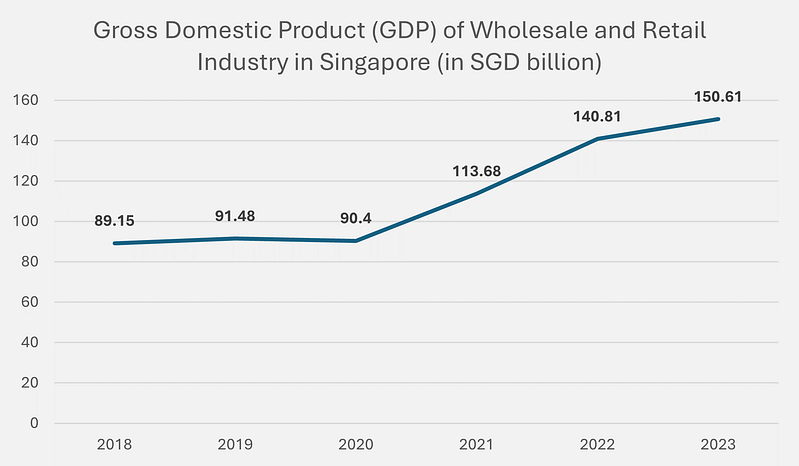

卸小売業はシンガポール経済の大部分を占め、2022年には18.6%の名目付加価値(VA)を記録しました(MTI、2023)。Romero(2024)によると、シンガポールの卸小売業界は2023年に約1,506億1,000シンガポールドルの貢献を記録しました。Mordor Intelligence(2024)によると、拡張現実(AR)と仮想現実(VR)の統合が、シンガポールの卸小売業界の今後のトレンドになると指摘されています。2019年の調査によると、小売業者の45%以上が2020年までにAR・VRソリューションを導入する計画を立てています。市場は魅力的ですが、寡占状態にあり、大手企業が市場を支配しています。これらの市場リーダーには、Japan Foods Holding Ltd、Sheng Siong Group Ltd、Watsons、ABR Holdings Ltd、Dairy Farm International Holdings(DFI)などが含まれます。企業がこの市場に参入する際には、高い参入障壁に対処する必要がありますが、今後5年間で3%以上のCAGRが見込まれています。

外食産業

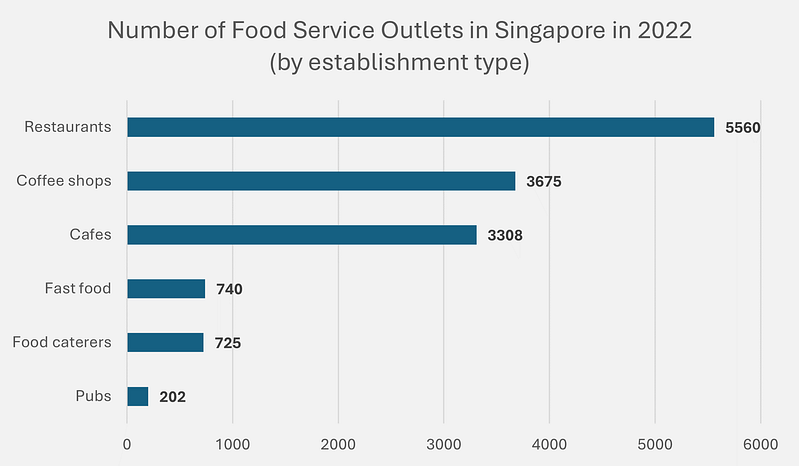

シンガポールの外食産業は、レストラン、ファストフード、カフェ、コーヒーショップ(フードコート、食堂)、パブ、およびケータリング業者が含まれます。Hirschmann(2023)によると、長時間労働の結果、シンガポール人の外食頻度が高くなっています。Mordor Intelligence(2024)によると、2024年までにシンガポールの外食産業の市場規模は約248億8,000万米ドルに達し、2024年から2029年までのCAGRは17.58%と予測されています。大手チェーン店が成長しており、2024年から2029年にかけて18%のCAGRが見込まれています。さらに、ゴーストキッチンへの需要も高まっており、2024年から2029年の予測期間中のCAGRは19.96%と予測されています。これらのトレンドは、外食産業における成長と機会の拡大を示しています。

交通機関

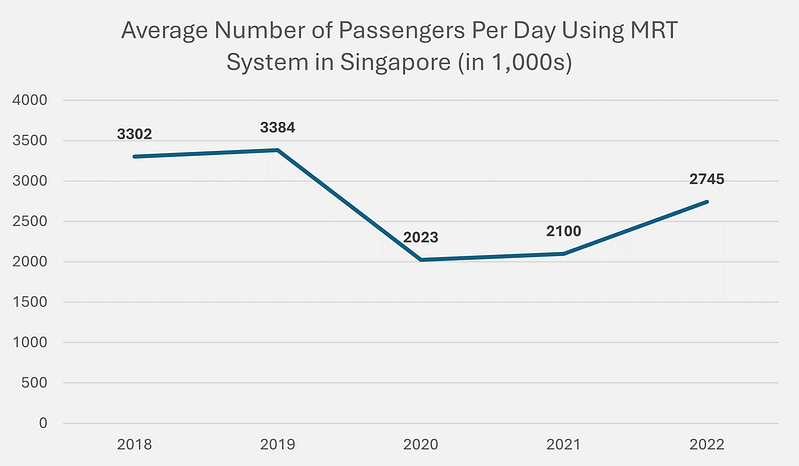

シンガポールは公共交通機関の世界的リーダーとして知られており、広範な地下鉄ネットワークと革新的なテクノロジーの利用が特徴です。2022年には、MRTシステムの路線が230キロメートルに達し、1日平均640万人の利用者がいます。公共交通市場は2024年までに大幅な成長が見込まれており、2024年までに約134億4,000万米ドルの収益に達すると予測されています。市場は1.28%の成長率で安定的に拡大し、2028年までには14億1,000万ドルに達する見込みです。テクノロジーの統合は、公共交通サービスの利便性と効率を向上させるために行われており、スマートテクノロジーの投資が行われています。